Credit scoring is very important in our financial lives. Whether you need to apply for a loan, a credit card, or even rent a house, your credit score often decides if you will be approved and what terms you will get.

Traditionally, banks and lenders used fixed rules and data from your history to decide if a person was good in credit score or not. But in this era, advanced artificial intelligence is changing the game. It is making credit scoring fast, more accurate, and fair. While also helping lenders reduce risk.

In this blog, we will discuss:

- What is a credit score?

- All the Problems with the Traditional scoring system.

- How machine learning is working to create credit score.

- Benefits for banks and the people who need loans.

- Challenges and concerns.

- The future of machine learning in finance.

1. What is Credit Scoring

Credit scoring is the process of assigning a number to show your wellness to pay back the money to get as loan.

- If you have a good credit score, it means you can pay the loan amount on time.

- A low score means you are considered risky for lenders.

These scores are based on your previous financial behavior, such as:

- Loan repayment history.

- The use of Credit cards.

- Time period of credit history.

- Number of credit accounts.

- Types of credit used.

Example: If you have always paid your bills on time and kept your debt low, your credit score will be good.

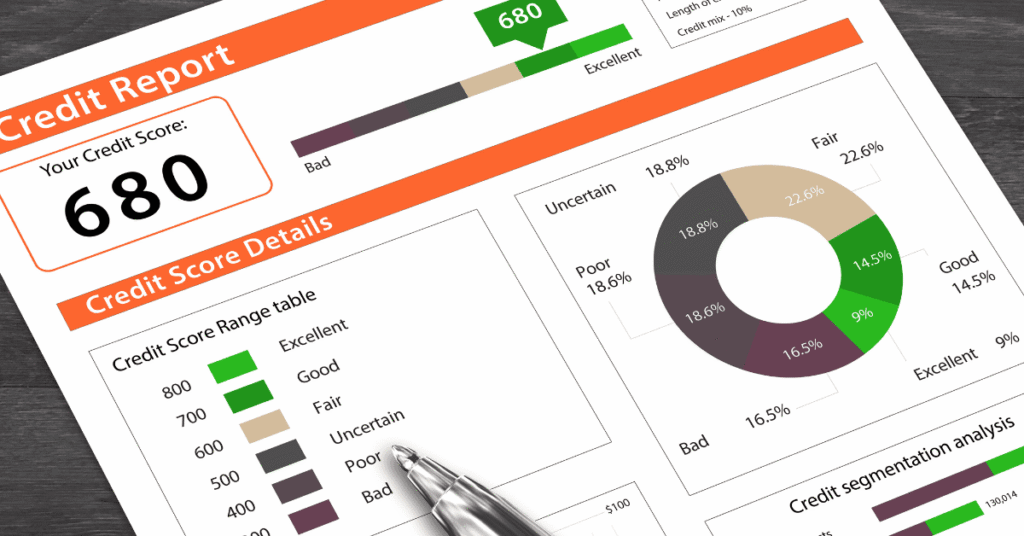

2. Problems with the Traditional Credit Scoring System

Traditional credit scoring systems, like FICO in the US, have been around for years. While they work well for many people, they also have limitations:

- Limited Data: They mostly depend on your credit history. If you are new to credit or have no loans yet, you may get a low score even if you are good at repayments.

- Static Rules: The scoring rules are fixed and may not capture recent changes in your financial situation.

- Slow Updates: It can take a long time for changes in your credit behavior to reflect in your score.

- Bias and Unfairness: People from certain backgrounds or with different types of income may be disadvantaged.

- Fraud Vulnerability: Scam activities can sometimes go undetected for too long.

3. How Machine Learning Improves Credit Scoring

Machine Learning is a branch of Artificial Intelligence (AI) that allows computers to learn from data and make predictions. Instead of following fixed rules, ML systems learn patterns from a large number of financial and behavioral data.

Here is how Machine Learning works in the process to consider credit score:

Step 1: Collect More Data

ML models don’t just look at credit reports. They can also use:

- Bank transaction history.

- Utility bill payments.

- Online purchase behavior.

- Social media signals.

- Employment behaviour.

- Mobile phone payment history.

This is called alternative data.

Step 2: Find Process

The machine learning system looks at the data and finds processes that fetch good or bad credit behavior.

Example: It may find that people who pay their phone bills on time are 40% less likely to default on loans.

Step 3: Make Predictions

When a new loan applicant applies, the system checks their data and predicts if the person is good at repayment or not.

Step 4: Keep Learning

Unlike manual systems, ML models keep updating as they receive more data, making them smarter over time.

4. Benefits of Machine Learning in Credit Scoring

Machine learning offers big advantages for both banks and the people who need loans.

For Banks and Investors:

- Better Accuracy: ML can detect subtle signs of risk that humans or fixed rules can miss.

- Faster Decisions: Loan approvals can happen in seconds instead of days.

- Fraud Detection: Unusual processes can be spotted on time, reducing losses.

- Cost Savings: Less manual work is needed for risk assessment.

For Borrowers:

- Fair Assessments: Even people with little or no credit history (such as students or small business owners) can get a fair score using alternative data.

- Quicker Loan Approvals: No long waiting times.

- Better Loan Terms: If you are low risk, you may get lower interest rates.

5. Real Life Examples of Machine Learning in Credit Scoring

- Upstart: A US based lending platform that uses ML to fetch education, job history, and skills in addition to credit reports.

- Zest AI: Zest AI is using ML to create more inclusive credit models, helping lenders approve more people without increasing risk.

- Experian Lift: Combines traditional and alternative data to score people with little credit history.

6. Challenges and Issues

While Machine Learning has great potential, it is not perfect. Some concerns include:

- Data Privacy: Using alternative data (like social media activity) raises privacy issues.

- Algorithm Bias: If the training data has biases, the ML model may also be biased.

- Lack of Transparency: ML models can be black boxes, making it hard to explain why a decision was made.

- Regulatory Issues: Financial regulations in some countries limit the type of data that can be used to consider credit score.

7. The Future of Machine Learning to Fetch Credit Score

Experienced ones believe ML will keep transforming credit scoring in the coming years. Possible future developments include:

- Real Time Credit Scoring: Your score could update urgently as your financial situation changes.

- Global Data Integration: International data sharing could make cross border lending easier.

- Explainable AI (XAI): AI models will become more transparent so borrowers can understand their scores.

- Hybrid Models: A mix of human oversight and ML predictions for the best of both worlds.

Final Thoughts

Machine learning is making the credit scoring process more accurate, faster, and fair. While there are challenges to address like bias and privacy, the benefits are too big to ignore.For lenders, it means smarter risk assessment.

For borrowers, it means more opportunities and better loan terms.